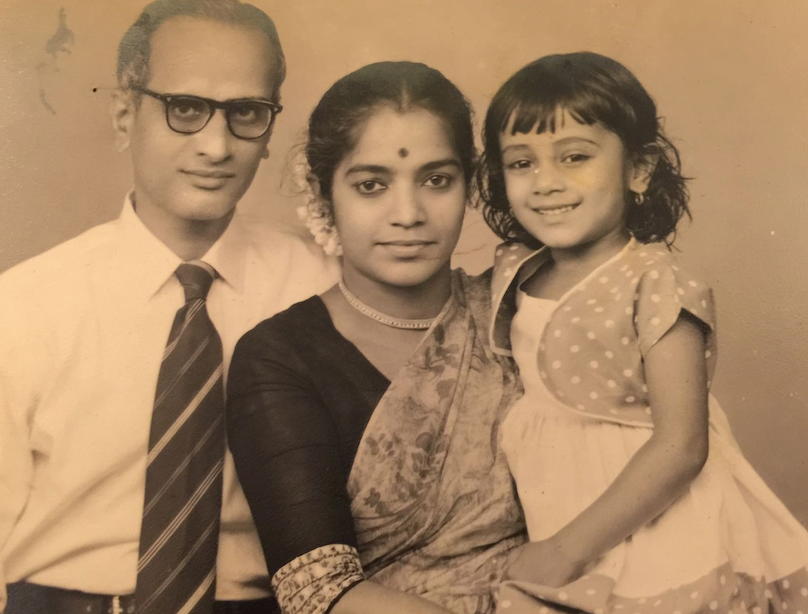

I was four years old when I traveled with my parents on the Queen Mary Ocean Liner to Washington D.C. when we moved there for my father’s diplomatic post at the Indian Embassy. That was my first taste of adventure and travel!

We moved back to India just before I started my teenage life; not an easy move for a 12, almost 13 year old. My parents wanted to be with family and look after their elderly parents. Turns out this experience influenced my life choices as well.

That move back to India at the age of 13 helped me learn early on that flexibility, maintaining a good attitude, perspective, determination and perseverance, are key to succeeding and achieving our dreams. Change is a constant and our life and related expense plans need to accommodate new dreams and curves in the road. Honing in on our dreams and desires are paramount and identifying WHY we want what we want is integral to keeping our enthusiasm over time.

I moved back home, to the United States, in my 20s and worked my way through graduate school. I earned my Masters in Library & Information Science at the top of my class and became a corporate librarian. This career and the skills learned are still near and dear to my heart and is the foundation of the research expertise that I have and use on a daily basis to analyze life’s options.

Work at what you love and do as much of it as you want to support your financial and personal freedom.

Over time I made a transition into a marketing career. In my time as a corporate librarian at a leading healthcare company I discovered I enjoyed learning about the business of healthcare. My love of business moved me to get my MBA. With the support of the company, I was able to make a transition into a marketing career via market research and business intelligence work for the company. I was now earning more, doing work I loved and had discretionary income to save and later invest.

Garden of Serenity at Home

I was now positioned to be able to develop and exercise my own money philosophy. In learning how to make sense of money, I learned that paying myself first and automating the process helped me build my portfolio.

I was on the path of personal growth, learning about personal finance and moving towards financial independence.

Why was this important? Financial and personal Independence enabled me to create options in my life…and ultimately design my life around my dreams and goals.

Design your life around your dreams

What is your WHY???

Resources that can help you:

- The Balanced Life Dreams Values Worksheet helps you prioritize your values and dreams. Align your spending and expense plan with your values and life goals.

- The Design Your Life Around Your Dream Goals Exercise and Worksheet: will help you prioritize your dreams, turn them into action steps and attach a cost to it. You can transfer this expense to your Financial Serenity template as a part of your Life Expense budget.

What are YOUR values and life dreams? What is your WHY??? Share your thoughts in the comments section!

Recent Comments